President Joe Biden’s proposed spending, in excess of entire fiscal (FY) budgets,[1] shows evidence of extraordinary financial ambition and effort to re-engineer America[2] in ways that may exceed that of Franklin D. Roosevelt’s (FDR) designs, efforts which appear to be a model upon which the president frames his administration, having met with historians on the matter.[3]

Unfortunately, the president and historians may be misreading history as they promote an approach to federal governance in 2021. There are parallels, namely a major economic downturn; however, the cause of these downturns helps illuminate the solutions. Whereas the Great Depression was the result of uncontrolled capitalism and insufficient government regulation,[4] the current crisis is one created by government actions, albeit in response to a virus. It was the result of extraordinary interventionism. Prior to the lockdown and other restrictive measures undertaken beginning in early 2020,[5] the United States (US) economy was enduring sustained growth, reflected by record lows in both unemployment and poverty rates.[6]

What is more, unlike the sweeping referendum that carried FDR into office and granted him the mandate to implement his expansive work and social insurance programs, less than half in the US were willing to vote for a socialist for president in the lead-up to the 2020 election.[7] By contrast, however, a majority of Democrats indicated they were.[8] The administration’s partisan progressive handling of the economy gives some evidence that the nation got the socialist president they did not want, which may be precisely what the outspoken democratic-socialist Alexandra Ocasio-Cortez (AOC) meant when she indicated the president had already “surpassed progressives’ expectations.”[9]

As for today, neither runaway market forces, nor the virus, caused the economy to collapse. Governments did.

Well-intentioned or not, effective or not in addressing public safety, government decisions actively decimated the economy and sent 22 million workers home, or to the unemployment line[10] where they were to wait for their government stipend. Now, claiming to be the solution to the very problem it helped create, the government’s proposed stimulus plans may prove larger than the New Deal itself.[11]

Meanwhile, consistent with the progressive push for a $15 per hour national minimum wage, which was removed from the American Rescue Plan, having been ruled ineligible for budget reconciliation by the Senate parliamentarian,[12] the president signed an executive order requiring the rate for federal contractors,[13] and more recently threw his support behind the $15 national minimum wage proposal.[14]

And as the president’s leadership sets the tone with his approval of spending that exceeds immediate needs, Congress has proposed returning to the era of pork barrel spending with attempts to add discretionary spending on district projects into the upcoming federal budget, including things such as $3M for a smartphone app to track buses in Utah, $1.8M for LGBTQ affirming professional medical care in Virginia, $1M to provide “comprehensive, culturally relevant medical and mental health services to the African American community” in Berkeley, $1M for “health equity clinics” in Pennsylvania, etc.[15]

Although the argument can be made for the inclusion of special projects to curry votes and bipartisanship – in fact, there are some who would say the elimination of such deals began to break Congress[16] – it clearly results in benefiting select, approved, communities and politicians.

In other words, Congress would be picking the winners and losers in the most obvious of ways, leaving the bill for everybody.

Should Coastal Tax Policies Go National

For centuries, debate has ensued over the degree to which governments should be actively involved in the economy, whether the populace is better served by an active hand or hands-free approach, most notably recognized through changes in tax policy and regulations. This was evident in the changeover from the pro-government solutions approach of Barrack Obama to the pro-business solutions approach of Donald Trump. The former was criticized as the ‘Regulator-in-Chief,’[17] issuing a litany of executive orders restricting businesses while increasing taxes to pay for the historic spending. The latter, a billionaire businessman, was criticized for favoring corporations through elimination of regulations[18] and lowering of taxes.[19]

In each case, policies are the respective philosophy’s answers to the questions of what create wealth and what society should do with such creation?

The Biden-Harris administration understandably favors the Obama-Biden approach to the economy and wealth generation; however, the spendthrift tone established by the new president, which more conservative economists might consider reckless, has not been met without warnings from liberal Keynesian economists as well. This includes inflationary concerns coming from advisors such as Larry Summers, former Director of the National Economic Council under Obama, who has repeatedly warned against excess spending,[20] most recently suggesting the economy is at risk of “overheating.”[21]

But the administration is clearly moving forward, dismissive of these concerns, instead, opting to bring a more liberal California or New York approach to the federal government, only with the added power to ‘print money.’ In doing so, it seems unconcerned with the potential negative consequences of such governance, namely, that the economic policies of these states have driven residents out while states with more libertarian policies, such as Texas and Florida, continue to attract Americans.[22],[23]

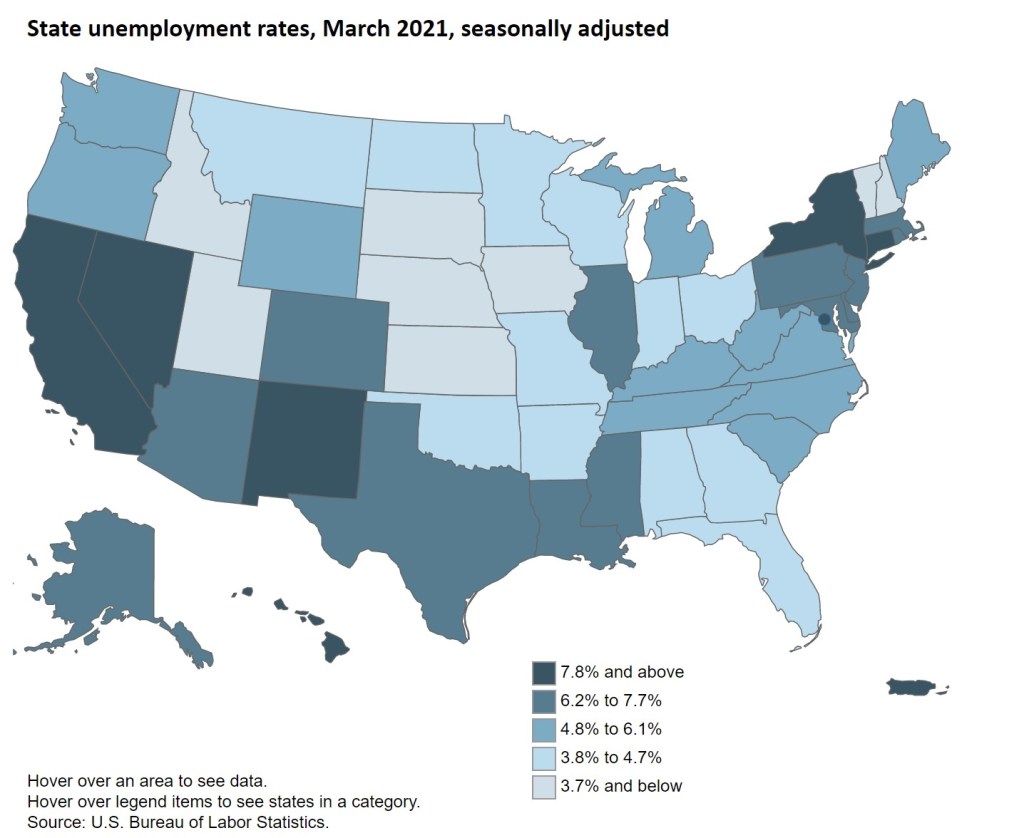

Not unsurprisingly, the most recent unemployment map[24] largely resembles the 2020 election map:

2020 Presidential Election

Where will citizens go when the policies that drive people out of states go national?

Rather than holding to, and promoting, the more traditional laissez-faire model that guided the nation’s dominant economy for decades, if not centuries, the Biden administration is taking steps to reshape the role of capitalism in the US leaving economists like Mark Zandi to recognize that “every corner of the country is going to be touched by this in some way.”[26]

There are even those who suggest the president may prefer the modern China model in which the government is the biggest player.[27]

To get there, the proposals include increases in tax rates, most notably the corporate tax rate, which was lowered in 2017, an attempt to make the US more competitive with other nations.[28] If passed as currently conceived, the new rate – raising it from 25.8% to 32.3% – would become the second highest amongst G20 nations. In addition to losing workers or limiting hiring capacity that accompanies higher taxes and the resulting loss in ability to reinvest in one’s company, in effort to offset the loss in revenue (or profits), costs would likely be passed along to consumers and existing wages, possibly stalling economic growth in the process. [29] By comparison, China, despite its communist policies and confiscatory practices,[30] has continued to attract and retain businesses with its lower tax rate (25.8%), exemptions[31] and incentives.[32]

Punishing success and profits while disincentivizing risks does little to promote growth.

But that is just the corporations.

What About Working?

Although costs may be passed onto individuals as a result of corporate tax policy, Biden has consistently stated that he will not directly raise taxes on those earning less than $400,000 per year.[33] Whether his proposals can proceed without raising taxes elsewhere remains to be seen; however, the first step to earning is working, and policies must be designed, in some measure, to encourage work.

With enhanced unemployment insurance (UI) provisions provided during the pandemic, such as tax exemptions[34] and plus-up benefits that raise the payments beyond the pre-established amount,[35] this supplemental relief may be disincentivizing a return to work, another government action that could easily slow the recovery. Conceptually, the added benefits should provide relief for those who would have remained employed were it not for the pandemic, and thus prevented from earning at their potential rates – rates they may require to keep up with their living expenses – but how far and how long can such a design proceed?

Despite the economy’s upward trajectory, a supplement was extended in the 2021 bill, leaving the more cynical to wonder if Democrats are trying to extend unemployment itself.

The White House denies that these factors are affecting a return to work, suggesting there is no evidence to support the claim,[36] but what about common sense? If a worker is paid nearly as much, if not more, to stay home, why would he/she want to return? And if he/she can only make a little more with full-time employment, is that worth their 40 hours of lost free time? Not dissimilar in philosophy to paid leave, a policy championed by liberals, the unemployed have been granted the authority to live with a semi-permanent paid vacation. Under such conditions, refraining from rejoining the workforce is a practical life and financial decision for many.

The concept of UI has always been to provide a safety net in the event one unexpectedly loses a job and cannot quickly gain employment, which is why there was a two-week delay in qualification. Now, added benefits and extended length provides legitimate alternative to working, or purposefully seeking to find work. UI was never meant to be permanent or make one whole, which is why there have been limits and caps, particularly for high earners, but low wage earners are benefitting to a greater degree simply because they can sustain their lifestyle without having to go back to work. This has proven quite common among young adults, who have been returning to their parents’ homes in such large numbers that for the first time since the Great Depression, a majority have moved back.[37] With such moves comes less financial responsibility, less need for gainful employment.

What, then, occurred following the UI extensions?

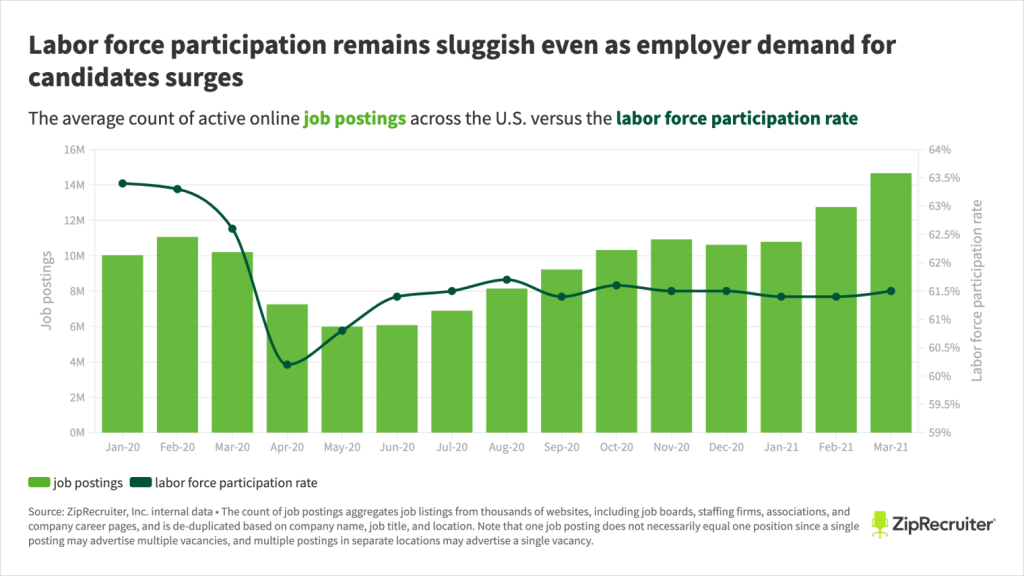

Per the latest jobs report, there were a record 8.1M jobs available,[38] yet the national unemployment rate rose to 6.1%[39] with a 75% reduction in jobs added. With labor force participation continuing to remain underwater, there is a clear disconnect between Washington think tanks, workers and the employers that are increasingly complaining of the difficulty in finding those willing to go back to work.[40]

The president recently announced that UI recipients who are offered jobs must take them[41] but how much more than rhetoric are such words – and how will it be enforced – when that provision is already a condition and beneficiaries need simply leave offers unreported?

Made worse, the Biden administration has tacitly approved of policies that prevent a practical return to the workforce,[42] such as teachers unions’ refusal to allow in-person learning for children,[43] leaving a disproportionate number of women home[44] as they remain caretakers.

In what may prove beneficial to the president, whether by accident or design, weakening the economic recovery provides additional support for more spending in the name of ‘stimulus’ and ‘recovery.’ In other words, the more money spent, the more damage can be inflicted, the more money can be spent to solve the damage created…

Beyond any impacts to the oft-criticized corporations, current policies have left small businesses competing for employees with a government that has no bottom dollar. In many cases, employers have been left offering minimum wage jobs at rates less than the government’s offer of non-work.[45] Consequently, several states, particularly those with lower costs of living, have begun proposing work requirements, employment incentives and cancelations of the UI plus-up benefits.[46]

It will be interesting to gauge which state policies yield more rapid results.

Inflation or Stagflation?

As the nation struggles to rebound from the economic downturn and many Americans are experienced caps on income – a function of UI benefits – there are early indications that prices are rising on consumer goods. Although these increases have been recognized by Federal Reserve Chairman, Jerome Powell, who described them as “transitory,”[47] there are indications that this may be a misread, or an understating of the situation. One month after passing the latest trillion-dollar bill, consumer prices showed a year-over-year increase of 2.6%, more than economists had predicted, and not simply assignable to rising fuel prices.[48] The effects of inflation were felt more broadly.

The next month’s report was even more dramatic, again exceeding economists’ expectations, showing a rise of 4.2%, the fastest increase since 2008. Even excluding the more volatile prices of food and energy, the core Consumer Price Index (CPI) rose 3% since the first trillion-dollar bill was passed in March 2020.[49] Although the Federal Reserve continues to define this as temporary, inflation is becoming real, not coincidentally following the injection of over $4T into the economy.

And since lower-wage earners spend the highest percentage of their income on essential products, or consumer goods, these impacts are affecting the more economically vulnerable members of society, the very class the Biden administration professes to prioritize, as with the support for an increase in the minimum wage. Although promising not to raise taxes on the lower and middle classes,[50] this could be described as a ‘hidden tax’ on all consumers, all Americans.[51]

If, however, increases in wages result to both incentivize workers to rejoin the workforce and pay for the increase in goods, that additional spending capacity could further exacerbate the growing inflation, a vicious cycle that begins with money flows and currency is devalued.[52]

And if these are indicators of the impact that $4T in spending had over the course of a year, what will happen if Biden’s additional $4T in spending passes in only a few months? What if believers in supply-side economics, such as Jeremy Siegel, were to prove prophetic when suggesting a resulting inflation could reach as high as 20%?[53]

If this course is permitted to persist, inflationary factors could largely wipe away the economic gains, rendering much of the spending initiatives a wash, leaving Americans in a pre-pandemic position familiar to January 2020, only facing higher prices and higher debts with lower real wages and purchasing power.

Though inflation can prove a headwind to a recovering economy,[54] demand exceeding supply, which is the common cause of price increases, could prove an indicator of a fundamentally strong economy, which is why many prefer to let market forces, rather than government, dictate the recovery.

What are the president’s expectations? Inject trillions of dollars into the economy but do not expect it to noticeably affect costs. Require wage increases but expect businesses to hire more employees. Raise taxes but expect growth in income and gross domestic product (GDP). Institute provisions that reward unemployment and approve of policies that prevent a practical return to work but expect workers to return to work.

Instead, these are actions that, if unaltered, could lead to stagflation.[55]

Interestingly, the last time the US experienced the combination of stagnant economic growth, high unemployment and high inflation was the decade following the passage and implementation of last wave of wholesale welfare expansion, Lyndon B. Johnson’s (LBJ) Great Society.[56] When met with the restricted oil supply, the US experienced a period of stagflation in the 1970s.

In what one would hope is not a harbinger, in addition to the expansionary policies promoted by the administration, Biden has moved to limit, albeit largely symbolically, US oil production through banning new drilling on federal lands.[57]

Despite the clear warnings and rational conclusions that could be reached by such policies, where the economy shows signs of slowing down, the administration has turned to blaming things on vaccine hesitancy.[58]

On the Line

Were the stakes of such a national overhaul not obvious, if the ultimate goals of these policies is to prove itself the vehicle of progressive long-term transformational change, the administration may want to consider the extent to which it is rapidly waging a national experiment, for its failure to deliver could, in the words of Democratic economic advisor, Steve Rattner, “set back the cause of progressivism for several more decades.”[59] Such failure may prove Biden more a Jimmy Carter than LBJ, and the former was quickly and decisively replaced by Ronald Reagan, who would lead the nation into its most conservative era since the 1950s.[60]

More likely, as with the greatest of economic woes, as experienced ahead of World War II, it was not simply the spending programs that solved the crisis. (Indeed, some contend it hindered the economy.) It was monetary policy, the cyclical nature of markets and the wartime economy.[61]

Despite claims to the contrary, a nation cannot simply spend itself out of economic hardship. In a productive society, the citizens themselves must be productive. They must work. Policies that prioritize that consistently succeed.

President Biden believes his plan does this.

The pandemic policies have left many Americans dependent on their government, and despite Biden’s continued efforts to expand its influence in their lives, the public continues to trust businesses more than governments.[62] Before becoming hooked on these subsidies, a nation founded on the premise of life, liberty and property – and a public that has long grown accustomed to freedom of movement – is likely to demand a return of the more traditional roles of business and government, and with it, an enhancement of their individual economic rights.

In the meantime, how much government and how many trillions will Americans see?

[1] The Budget and Economic Outlook: 2020 to 2030, (Congressional Budget Office, 2021)

[2] Mike Allen and Jim VandeHei, Biden’s New Deal: Re-engineering America, quickly, (Axios, 2021)

[3] Mike Allen, Biden’s private chat with historians, (Axios, 2021)

[4] Anne Field, The main causes of the Great Depression, and how the road recovery transformed the US economy, (Britannica, 2020)

[5] Shannon Meraw, The federal government’s coronavirus response—Public health timeline, (Brookings, 2020)

[6] Reality Check Team, US 2020 election: The economy under Trump in six charts, (BBC News, 2020)

[7] Lydia Saad, Socialism and Atheism Still U.S. Political Liabilities, (Gallup, 2020)

[8] Hunter Moyler, 76 Percent of Democrats Say They’d Vote for a Socialist for President, New Poll Shows, (Newsweek, 2020)

[9] Sarah Elbeshbishi, AOC praises Biden administration, says it has surpassed progressives’ expectations, (USA Today, 2021)

[10] Jeffry Bartash, The U.S. has only regained 42% of the 22 million jobs lost in the pandemic. Here’s where they are, (Market Watch, 2020)

[11] Juliana Kaplan, Biden’s stimulus looks bigger than the New Deal, economics professor says, (Business Insider, 2021)

[12] Jacob Pramuk, $15 minimum wage not allowed in Biden’s Covid relief bill, Senate official says, (CNBC, 2021)

[13] Dartunorro Clark, Biden signs executive order raising federal contractors’ minimum wage to $15 an hour, (NBC News, 2021)

[14] Chauncey Alcom, Fight for $15 minimum wage heats up after Biden’s endorsement, (CNN, 2021)

[15] Remy Numa, 50 eye-popping earmarks requested by lawmakers in upcoming federal budget, (Fox News, 2021)

[16] McKay Coppins, The Man Who Broke Politics, (The Atlantic, 2018)

[17] Richard A. Epstein, Our Regulator-In-Chief, (Hoover Institute, 2016)

[18] Tracking deregulation in the Trump era, (Brookings, 2020)

[19] Galen Hendricks and Seth Hanlon, The TCJA 2 Years Later: Corporations, Not Workers, Are the Big Winners, (Center for American Progress, 2019)

[20] Greg Robb, Summers says Fed should express more concern over inflation outlook, (Market Watch, 2021)

[21] John Harwood, Larry Summers sends inflation warning to White House: Dominant risk to economy is ‘overheating’, (CNN, 2021)

[22] Chris Dorsey, America’s Mass Migration Intensifies, As ‘Leftugees’ Flee Blue States And Counties For Red, (Forbes, 2021)

[23] Where are Americans Moving? (North American, 2021)

[24] State unemployment rates, seasonally adjusted, (United States Bureau of Labor Statistics, 2021)

[25] Presidential Results, (CNN, 2021)

[26] Jonathan Easley, Brett Samuels and Amie Parnes, White House moves to reshape role of US capitalism, (The Hill, 2021)

[27] Jacob M. Schlesinger and Andre Restuccia, Behind Biden’s Big Plans: Belief That Government Can Drive Growth, (The Wall Street Journal, 2021)

[28] Joseph W. Sullivan, Trump Was Right to Prioritize America’s Competitiveness Over Inequality, (The Atlantic, 2020)

[29] Matthew D. Dickerson, Biden’s Business Tax Hikes Would Be a Self-Inflicted Mistake for America, (Heritage, 2021)

[30] Eric Rosenbaum, 1 in 5 corporations say China has stolen their IP within the last year: CNBC CFO survey, (CNBC, 2019)

[31] Reuters Staff, China widens income tax exemption for foreign investors, (Reuters, 2018)

[32] Sui-Lee Wee, China Offers Tax Incentives to Persuade U.S. Companies to Stay, (The New York Times, 2017)

[33] Allan Smith and Kristen Welker, Biden says he plans ‘small to significant’ tax hike for those making over $400,000, (NBC News, 2021)

[34] New Exclusion of up to $10,200 of Unemployment Compensation, (Internal Revenue Service, 2021)

[35] Tami Luhby, Why Republicans are ready to kill the $300 pandemic unemployment boost, (CNN, 2021)

[36] Nicholas Reimann, White House Says $300-A-Week Unemployment Benefits Are Not Causing Worker Shortages, (Forbes, 2021)

[37] Richard Fry, Jeffrey S. Passell and D’Vera Coohn, A majority of young adults in the U.S. live with their parents for the first time since the Great Depression, (Pew Research Center, 2020)

[38] Megan Henney, Job openings surge to record 8.1M, but businesses struggling to hire workers, (Fox Business, 2021)

[39] U.S. unemployment rate: seasonally adjusted April 2021, (Statista, 2021)

[40] Kat Lonsdorf, Millions Are Out Of A Job. Yet Some Employers Wonder: Why Can’t I Find Workers? (NPR, 2021)

[41] Alana Wise, Americans Will Lose Unemployment Benefits If They Turn Down Jobs, Biden Says, (NPR, 2021)

[42] Collin Binkley, Reopening debate testing Biden’s ties with teachers unions, (Associated Press, 2021)

[43] Anthony L. Fisher, Teachers union are gaslighting parents and resisting science keep schools closed, (Business Insider, 2021)

[44] Katica Roy, Women’s labor force participation set back three years due to COVID-19, (The Hills, 2020)

[45] Amelia Thomson-DeVeaux, Many American Are Getting More Money From Unemployment Than They Were From Their Jobs, (FiveThirtyEight, 2020)

[46] Shahar Ziv, As States Stop Extra $300 Unemployment Benefits, More Dems Skeptical Of Extension, (Forbes, 2021)

[47] Irina Ivanova, Federal Reserve calls inflation “transitory” as it keeps interest rates near zero, (CBS News, 2021)

[48] Anneken Tappe, Practically everything is getting more expensive in America, (CNN, 2021)

[49] Jeff Cox, Inflation speeds up in April as consumer prices leap 4.2%, fastest since 2008, (CNBC, 2021)

[50] Joseph Zeballos-Roig, Joe Biden promises he won’t raise taxes for people earning under $400,000 if elected, (Business Insider, 2020)

[51] Kristin Tate, Growing inflation is Biden’s hidden tax on working Americans, (The Hill, 2021)

[52] Peter Morici, Opinion: Inflation may be on Biden’s plate sooner than he thinks, (Market Watch, 2021)

[53] Dan Weil, Siegel Says Inflation May Hit 20% – but Still Sees Stocks Rising, (MSN, 2021)

[54] Lenore Elle Hawkins, What is Inflation, and is it Good or Bad? (Nasdaq, 2021)

[55] Kimberly Amadeo, Stagflation and Its Causes, (The Balance, 2020)

[56] Leslie Kramer, How the Great Inflation of the 1970s Happened, (Investopedia, 2021)

[57] Jennifer Hiller and Nichola Groom, Big U.S. oil drillers have federal permits to mute effect of any Biden ban, (Reuters, 2021)

[58] Press Briefing by Press Secretary Jen Psaki, Secretary of Energy Jennifer Granholm, and Secretary of Homeland Security Alejandro Mayorkas, May 11, 2021, (White House, 2021)

[59] Nicole Fallert, Obama Official Steve Rattner Says Biden Could Set Progressivism Back Decades if Massive Government Expansion Fails, (Newsweek, 2021)

[60] Elizabeth Dohms-Harter, How Reagan Helped Usher In A New Conservatism To American Politics, (Wisconsin Public Radio, 2020)

[61] Richard H. Pells, Great Depression, (Britannica, 2021)

[62] Edelman Trust Barometer 2021, (Edelman, 2021)

One thought on “The Biden Administration Is Tackling the Economy: Will It Go Down?”